By Shangox

Introduction: The Fraud No One Talks About

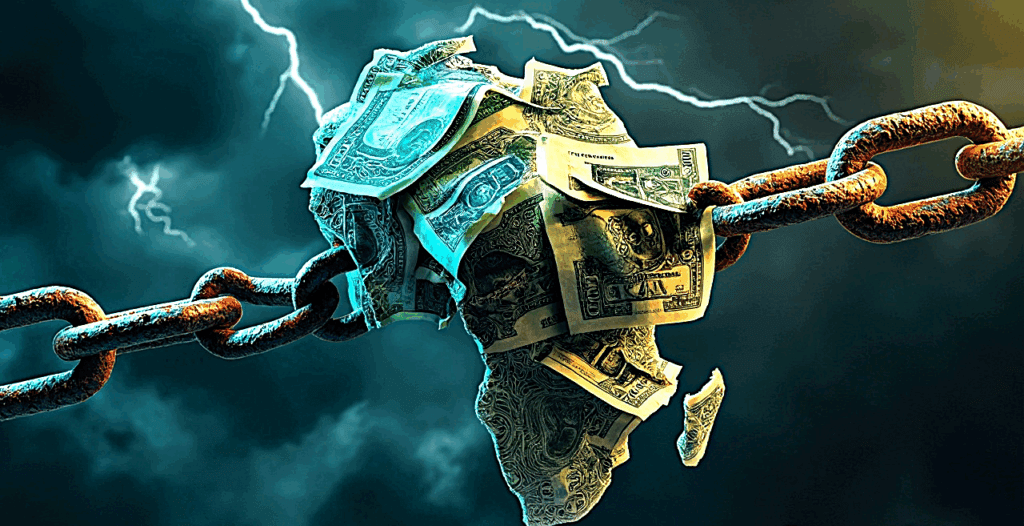

Africa is not poor. It has never been poor. It is the richest continent in terms of natural resources, cultural capital, and human potential. Yet, from Ghana to Zambia, from Nigeria to Senegal, it remains shackled in debt.

This is not an accident. It is not mismanagement. It is financial warfare, executed through loans that never truly existed — issued by global institutions whose power rests on fiction, and whose interest lies in perpetual African dependency.

We have been told for decades that debt is the price of development. That loans from the IMF and the World Bank are the medicine Africa must take to cure its ills. But the truth is far more sinister: Africa has been defrauded — systematically, deliberately, and unapologetically — through a process of debt creation based on nothing but digital promises.

Let us now expose the machinery of this fraud.

Part I: The Banking Illusion — Money Created from Thin Air

When people think of loans, they imagine a bank handing out money it holds in reserve. This is false. In reality, when commercial banks issue loans, they do not transfer pre-existing money. They create money out of thin air — with a keystroke. This process, known as credit creation, forms over 90% of the money supply in most modern economies.

The borrower is then required to pay back this fictional money with real labor, real time, and real interest.

Now, apply this model to nations.

When the IMF or World Bank loans money to an African country, it is not giving away real assets. These loans are usually denominated in Special Drawing Rights (SDRs), or in fiat currencies like the dollar or euro — all of which are unbacked, abstract constructs. These institutions are lending digital figments in exchange for real power over national policies, state assets, and public life.

The corruption lies in the very architecture of this lending. A loan that does not exist in any tangible form is enforced through real-world consequences — austerity, privatisation, and poverty. These fake loans are enforced by global finance courts and rating agencies, backed by political pressure and economic sanctions. The money itself is conjured by keystrokes in Western capitals, while the burden falls on African streets, hospitals, and schools.

This is not development; it is entrapment. It is financial sorcery dressed in policy suits. And all this happens while Africa is systematically prevented from trading fairly on the global stage. Tariff regimes, trade quotas, and skewed pricing mechanisms ensure that Africa earns less than it deserves for its resources. While the West prints money to lend, Africa bleeds wealth to repay — in gold, oil, cocoa, cobalt, and human toil.

It is a modern-day miracle: creating chains without ever forging metal.

Part II: From Independence to Indebtedness — A Timeline of Entrapment

1950s–1960s: The Moment of Hope

As African nations gained independence, there was widespread optimism. Leaders like Kwame Nkrumah envisioned industrial self-reliance, and thinkers like Julius Nyerere and Thomas Sankara championed African socialism and unity.

But Western powers had no intention of allowing true independence. If colonialism was ending politically, it would be reborn economically.

1970s: The Bait

Flush with petrodollars, Western banks began aggressively lending to developing nations. African countries, newly independent and desperate for capital, were offered easy credit. Infrastructure projects were proposed, advisers poured in, and the IMF smiled.

But these loans came with variable interest rates. When rates spiked in the early 1980s, debt ballooned. The trap was set.

1980s: The Ambush – Structural Adjustment Programs (SAPs)

When African countries couldn’t repay, the IMF and World Bank stepped in — not with relief, but with structural adjustment programs (SAPs). These demanded:

- Currency devaluation

- Privatization of public assets

- Removal of subsidies

- Cuts to health and education

- Opening of markets to foreign goods

These policies decimated local industries, weakened governments, and handed over Africa’s economic sovereignty to Washington.

“The IMF came to us not with medicine, but with poison disguised as aid,” said Julius Nyerere.

SAPs did not reduce debt. They deepened it. From 1980 to 2000, Africa paid back over $240 billion in debt and still owed over $300 billion.

The cycle had begun.

Part III: Case Studies in Swindle

Ghana – From Nkrumah’s Dream to IMF Dependency

Ghana was the first African country to gain independence, led by the visionary Kwame Nkrumah. His policies centered on industrialization and pan-African unity.

But by the early 1980s, Ghana was trapped in IMF debt. The Rawlings administration adopted SAPs, devalued the cedi, slashed social services, and sold off state-owned enterprises.

The results? Temporary economic growth — but long-term dependency. Ghana returned to the IMF multiple times, including in 2015 and again in 2022. A country rich in gold and cocoa now borrows to pay salaries.

Nigeria – Oil-Rich and Debt-Burdened

Nigeria, Africa’s largest economy, earned hundreds of billions in oil revenue. Yet it remains one of the world’s most indebted nations. Why?

In the 1980s, Nigeria adopted SAPs under IMF pressure. Subsidies were removed, the naira was devalued, and industries collapsed.

Today, Nigeria spends more than 90% of its revenue servicing debt, including debts taken under questionable Eurobonds and opaque Chinese deals. Despite vast natural wealth, Nigerians live in an economic paradox: rich soil, poor people.

Zambia – The Mining Colony in Disguise

Zambia is one of the world’s top copper producers. Yet in 2020, it became the first African country to default on Eurobond debt during the COVID-19 pandemic.

Under IMF guidance, Zambia privatized its mines in the 1990s. Today, most of its copper is extracted by foreign companies that pay minimal tax. The wealth leaves; the debt stays.

In effect, Zambia is a mining colony run by international finance, not a sovereign nation.

Part IV: Debt as Neo-Colonial Weapon

These loans were not neutral. They were not development tools. They were weapons.

Debt is now the preferred method of control. It allows foreign powers to:

- Dictate national budgets

- Control currency values

- Undermine local industries

- Force privatization

- Capture resources through collateral agreements

This is neo-colonialism without a single soldier. It is colonization through code, contracts, and conditionalities.

And the moral cover is always the same: “We are helping Africa reform.”

Part V: The Religious Mask – Morality as Control

Debt is often framed in religious terms — of morality, discipline, and repentance. IMF and World Bank technocrats speak of “fiscal responsibility” and “good governance” as if they are priests of a global financial church.

African leaders are treated like sinners. Bailouts are framed as redemption. But this is not salvation — it is subjugation.

The theology of debt has replaced the theology of liberation. The message is clear: bow to the market, or be punished.

Part VI: The African Monetary Fund — Breaking the Chains

There is a way out. Africa must create its own financial institutions, rooted in sovereignty and solidarity.

The African Monetary Fund (AMF) must:

- Be backed by African currencies and resources

- Issue low-interest or interest-free loans

- Reject conditionalities

- Operate under democratic control by member states

- Develop a pan-African digital currency to rival SDRs

Africa does not need the IMF. It needs itself.

Conclusion: Phantom Chains, Real Pain

Africa is in debt. But not to real lenders. It is in debt to ghosts — to entities that created nothing and extracted everything.

The IMF and World Bank did not help Africa rise. They helped Africa kneel.

We must now ask:

Who truly owes whom?

Africa owes nothing to those who printed shackles and called them loans. The time has come for a new consciousness — a Neo Liberationist revolution — that reclaims value, redefines wealth, and restores the dignity of a continent that has been robbed not just of gold and oil, but of truth.

The chain is an illusion. Break it.